Compare

Atlar vs Agicap

Agicap relies on third-party PSD2 open banking connections and lacks payment capabilities. Atlar is a more robust treasury platform that lets you go live fast.

3 reasons to choose Atlar over Agicap

Bank connectivity

Bank connectivity

Bank connectivity you can rely on

Agicap connects to customer bank accounts through PSD2 or open banking APIs. These APIs are designed for consumer data sharing and are poorly maintained by banks – causing occasional reliability issues. Atlar offers both in-house bank connectivity through channels like SFTP, Swift, and EBICS plus real-time API connections to modern tools.

Payments

Payments

Built-in payment capabilities

Agicap is suited to day-to-day cash management and lacks the ability to easily make payments. In order to actually move money, customers will need to use another solution or log in to a bank portal. Atlar combines user-friendly cash management, forecasting, and reporting tools with payment and approval workflows, all from inside the same dashboard.

Scalable platform

Scalable platform

Scalable platform that lets you do more

Agicap appeals to smaller businesses looking for an easy tool to monitor cash flow. Atlar lets you do that and much more. Choose a dedicated treasury platform built to handle higher transaction volumes that can scale reliably with your business. With Atlar, you won’t have time to find a new provider every couple of years as your business grows.

Is Agicap the right solution for your team?

Real customer reviews on G2 and TrustRadius

“There were some setbacks with our bank connections before the EBICS contracts were put in place.”

“I have a few issues with bank synchronization, however customer support is doing their best to figure out how to fix it.”

“The supplier payment module has some limitations in returns and searches. The accounting interface isn’t suitable for a company making monthly statements.”

“Eventual sync errors; lag in the update of transactions (improvement possible); limited billing tool (e.g. not possible to select different bank accounts).”

“Sometimes long wait times for customer support. Tax rates aren’t transferred correctly to DATEV during pre-accounting.”

“Sometimes, depending on the bank, the connection between the bank and Agicap doesn’t work properly.”

What customers say about Atlar

Real customer reviews on G2 and TrustRadius

“One of Atlar's standout qualities is undoubtedly its ease of implementation. The process is straightforward, making it accessible even to those who may not be as tech-savvy.”

“Atlar has been a game-changer for us. The ease of use and implementation is what stands out for me. I really can't think of any things that I don't like with the tool.”

“Modern, user-friendly interface that doesn’t compromise functionality. With its intuitive design, users can easily navigate the system. Atlar's time-saving aspect cannot be overstated”

“Atlar has been great from the start. Remarkably user-friendly, streamlined implementation process, and outstanding support, ensuring a seamless experience for our team.”

“It helps us decrease cost by reducing manual processes we do daily. The implementation was also very straightforward and the Atlar team was very helpful.”

“User-friendly platform that significantly streamlines operations. Intuitive dashboard and time-saving features make it an ideal choice for enhancing efficiency.”

Compare Atlar vs Agicap

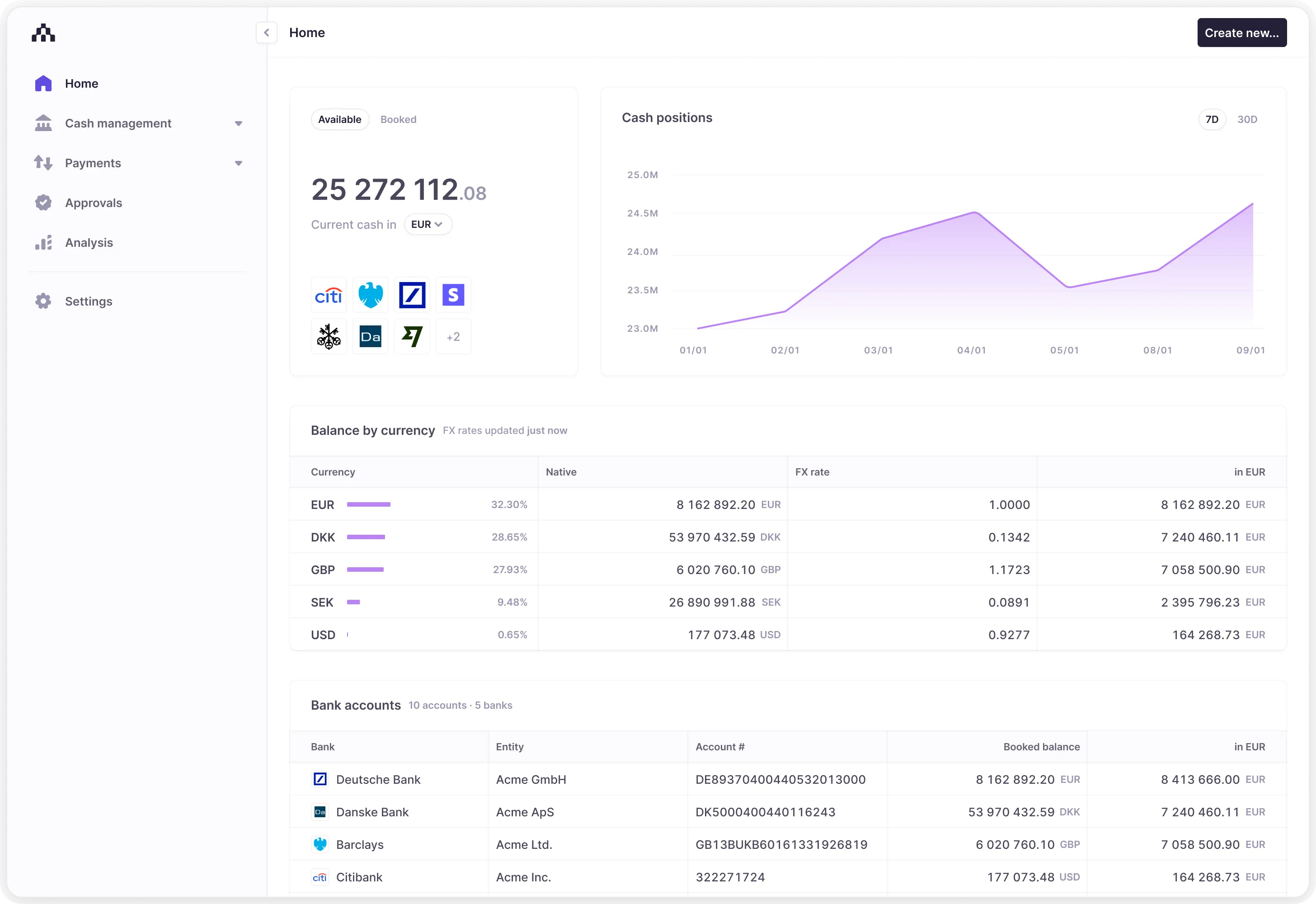

Altar combines the core functionality of traditional treasury software with modern API connectivity, real-time reporting, and user-friendly tools.

Why the Loomis Pay team chose Atlar over less robust alternatives, saving 120 hours / week

Loomis Pay, part of publicly listed cash handling firm Loomis, selected Atlar as its partner to eliminate manual work with one central treasury system. All bank accounts globally were connected to Atlar in 3 weeks, helping the finance team get off to a running start.

Get started

See a demo

Discover the Atlar platform for yourself. Enter your email to get started.