Compare

Atlar vs Kyriba

Kyriba is over two decades old and can take longer to implement. Atlar is a more modern way to manage money – and lets you get up and running in weeks.

3 reasons to choose Atlar over Kyriba

Quick to implement

Quick to implement

Cut months off your implementation time

Kyriba is based on two-decades old tech that requires IT resources to implement. Expect a months-long wait even with the help of specialist consultants – and then some teams will need hours of training before they can use it. Atlar customers get up and running in 4-6 weeks on average with zero implementation or maintenance work needed.

Easy to use

Easy to use

Fast, modern, and responsive platform

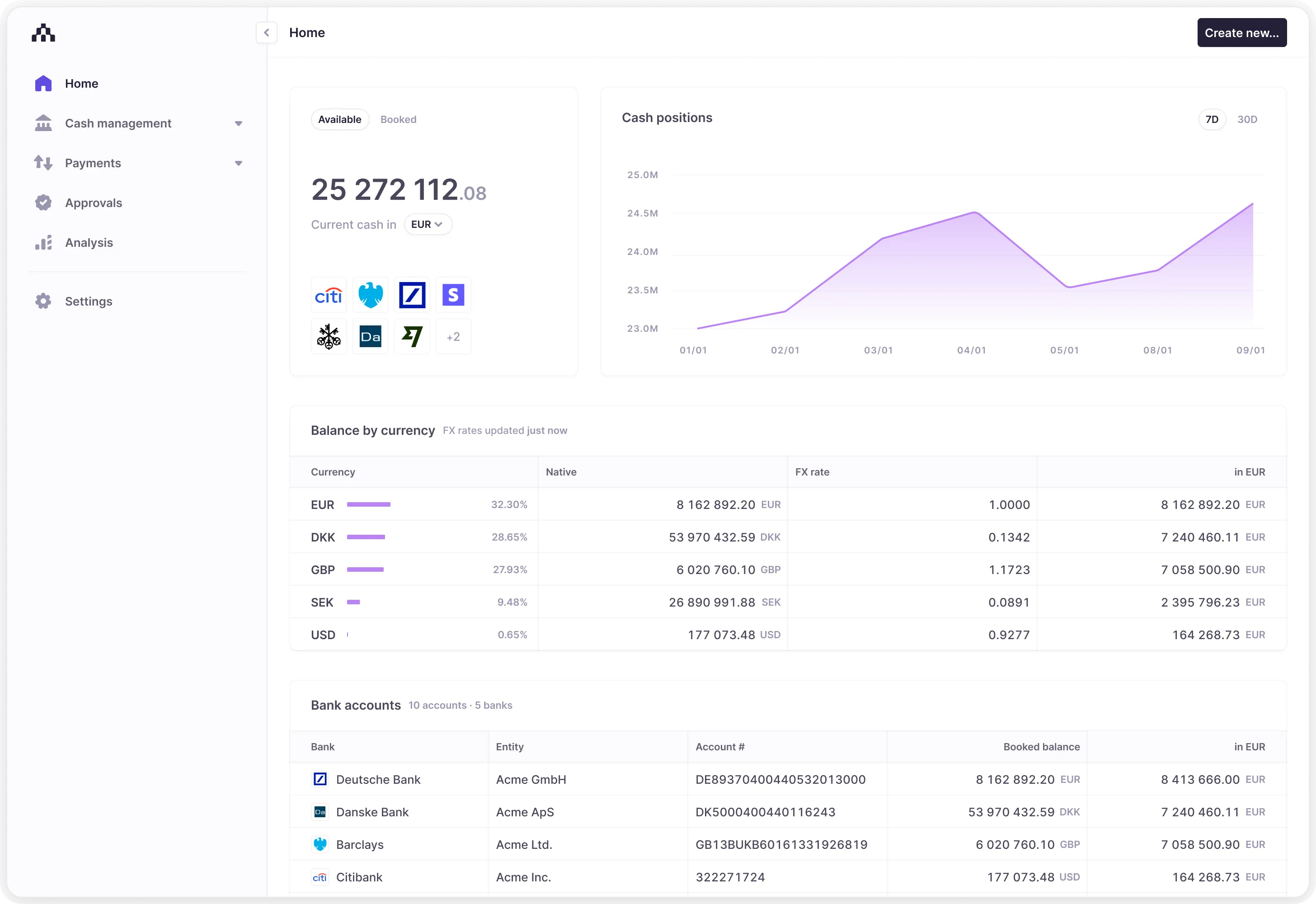

Many teams find there’s a steep learning curve when starting to use Kyriba because of the complex and intricate design. This can lead to slower adoption internally – and may mean dedicating one or more employees to training full-time. Atlar is designed with ease of use and modern UX principles in mind, so that even advanced features add value from day one.

Connects to modern tools

Connects to modern tools

Real-time, API-ready connectivity

Kyriba connects to banks through their traditional channels but isn’t designed to integrate with modern API-first platforms. Atlar does both and more, with built-in support for real-time payments and data. Instead of batched files and siloed systems, Atlar can receive data continuously in real time from any source – giving a complete, accurate view of your finances.

Is Kyriba the right solution for your team?

Real customer reviews on G2 and TrustRadius

“Implementation is highly complex. There is a significant learning curve in using the solution, and banks need to be on board. Banks differ in how well they connect to Kyriba. Costs are significant.”

“Kyriba is not very intuitive. It takes time and a ton of effort to leverage as an asset. Classes and seminars to learn more about Kyriba are incredibly expensive on top of your annual fees.”

“The time it takes to learn Kyriba cannot be overstated. Do not think you will implement and be off to the races. We had to dedicate an entire person on our team to get it up and running.”

“Setup and access can be cumbersome. At times, the interface freezes up depending on how many users are using the platform. The customer experience could do with some upgrades.”

“Implementing Kyriba was a heavy lift in terms of time and resources. At each stage there is a new layer to learn about the system. This requires the commitment of resources and staff.”

“Implementation is complicated. Adding a feature or account is tedious. Communication between Kyriba and the bank is usually a bottleneck. Software is complex and not intuitive.”

What customers say about Atlar

Real customer reviews on G2 and TrustRadius

“One of Atlar's standout qualities is undoubtedly its ease of implementation. The process is straightforward, making it accessible even to those who may not be as tech-savvy.”

“Atlar has been a game-changer for us. The ease of use and implementation is what stands out for me. I really can't think of any things that I don't like with the tool.”

“Modern, user-friendly interface that doesn’t compromise functionality. With its intuitive design, users can easily navigate the system. Atlar's time-saving aspect cannot be overstated”

“Atlar has been great from the start. Remarkably user-friendly, streamlined implementation process, and outstanding support, ensuring a seamless experience for our team.”

“It helps us decrease cost by reducing manual processes we do daily. The implementation was also very straightforward and the Atlar team was very helpful.”

“User-friendly platform that significantly streamlines operations. Intuitive dashboard and time-saving features make it an ideal choice for enhancing efficiency.”

Compare Atlar vs Kyriba

Altar combines the core functionality of traditional treasury software with modern API connectivity, real-time reporting, and user-friendly tools.

Why the Loomis Pay team chose Atlar over a legacy treasury solution, saving 120 hours / week

Loomis Pay, part of publicly listed cash handling firm Loomis, selected Atlar as its partner to eliminate manual work with one central treasury system. All bank accounts globally were connected to Atlar in 3 weeks, helping the finance team get off to a running start.

Get started

See a demo

Discover the Atlar platform for yourself. Enter your email to get started.